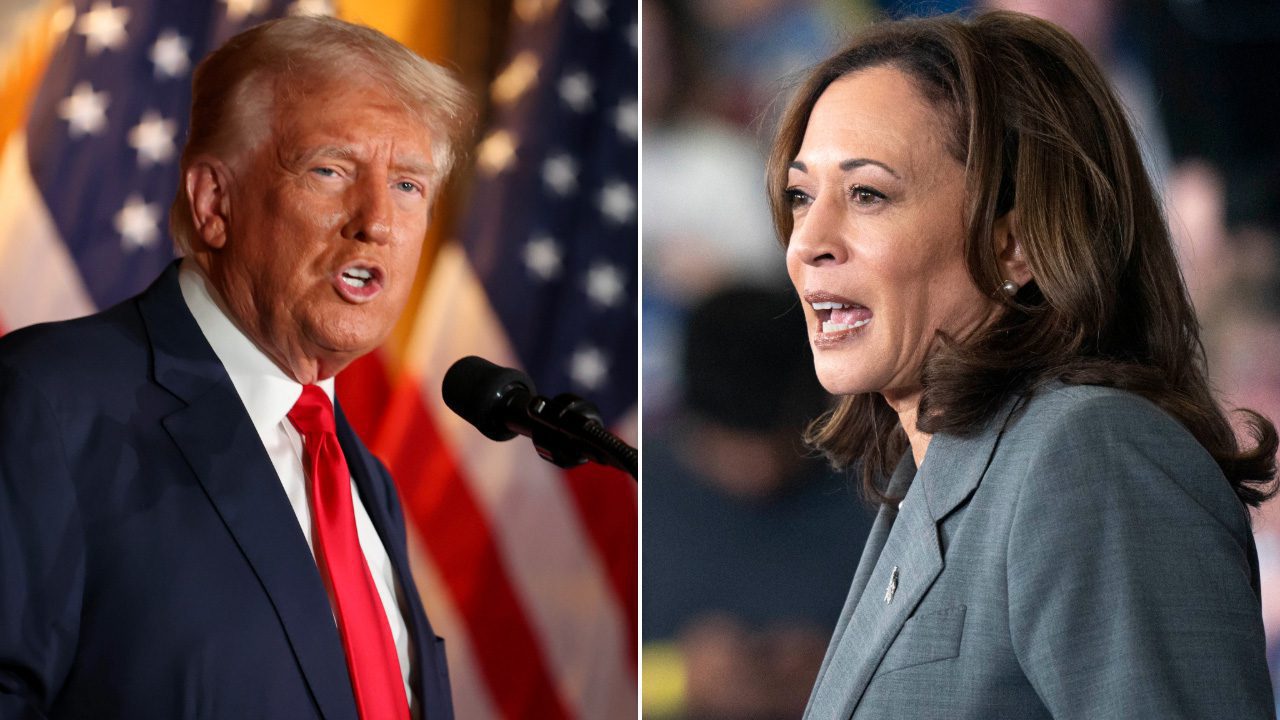

The economy has emerged as the top issue for voters in the upcoming presidential election as Vice President Kamala Harris and former President Donald Trump are set to face off for the first time on the debate stage Tuesday night.

A Fox News poll conducted Aug. 9-12 found that the economy was the top issue facing voters, with 38% of respondents saying it will be the most important issue in deciding their vote for president – more than the next two issues combined.

Trump and Harris will look to convince voters that they have the best plan for America’s economy when they take the debate stage in Philadelphia on Tuesday night at 9 p.m. ET. The presidential debate is hosted by ABC News and will be simulcast on Fox News and FOX Business Network.

Here is a look at some of the top economic issues that will be on voters’ minds as they tune in to Tuesday night’s debate and cast their ballot ahead of Election Day on Nov. 5.

TRUMP-HARRIS DEBATE CHAT: JOIN AMERICA’S CONVERSATION HERE!

The U.S. economy is still dealing with stubborn inflation that was spurred in part by supply chain disruptions during the COVID-19 pandemic, as well as record-setting levels of government spending aimed at mitigating the economic impact of the crisis.

Inflation surged from 1.4% in January 2021 to a 40-year high of 9.1% in June 2022 – an amount more than four times the Federal Reserve’s 2% target rate. The Fed began raising the benchmark federal funds rate in early 2022 in an effort to tamp down inflation and raise interest rates.

Though inflation has subsided, it remained at 2.9% as of July and interest rates currently sit at a 23-year high at a range of 5.25% to 5.5%. While the Fed is expected to cut interest rates at its meeting next week, the residual inflation and the impact of high interest rates have strained Americans’ budgets as the economy has cooled off.

INFLATION IS UP 20% SINCE BIDEN TOOK OFFICE

A shortage of housing around the U.S. has resulted in home prices hitting a new record in June, with prices up 5.4% from a year ago, according to the S&P CoreLogic Case-Shiller index. The report found that price increases were even higher in America’s largest metro areas, with a 10-city composite index showing a 7.4% annual increase and a 20-city composite posting a 6.5% gain.

Elevated interest rates stemming from the Fed’s inflation fight have pushed mortgage rates higher, making it more difficult for Americans to afford to buy a house, worsening the affordability challenge for would-be buyers in a market with limited inventory. Harris and Trump have each rolled out housing plans aimed at making homeownership more attainable.

HOME PRICES JUST SMASHED ANOTHER RECORD HIGH IN JUNE

Trump has said that he would open limited portions of federal land to home construction, cut regulations that add to housing costs, promote tax incentives for homeownership and first-time buyers, and curb inflation to reduce interest rates.

Harris has proposed creating a $40 billion housing innovation fund, creating a new $25,000 tax credit for first-time homebuyers and expanding tax credits to incentivize construction of affordable housing. Her campaign has also set a goal of building 3 million new houses.

Trump and Harris have each outlined sharply contrasting tax plans ahead of the election.

The former president has called for the 2017 tax reform he enacted, known as the Tax Cuts and Jobs Act, to be made permanent as the lower tax rates for individuals under the law are due to expire at the end of 2025. He has also proposed lowering the corporate tax rate for businesses that make products in America from 21% to 15%, as well as ending taxes on tips and Social Security benefits and expanding the child tax credit.

Harris has called for the Tax Cuts and Jobs Act to be repealed for all households making more than $400,000 annually. She would raise the corporate tax rate for all companies from 21% to 28%, quadruple the tax on stock buybacks, raise the capital gains tax rate to 28%, and impose a 25% “minimum” tax on realized and unrealized income for high-wealth households. Her tax plan also includes an expanded child tax credit and no taxes on tipped income.

TRUMP, HARRIS TOUT TAX PLANS AHEAD OF PRESIDENTIAL DEBATE

High interest rates and a more cash-strapped consumer have resulted in the labor market cooling amid the Fed’s push to slow inflation down to its target rate.

The economy added just 142,000 jobs in August, missing economists’ expectations of 160,000. The Labor Department’s July jobs report was also revised downward from 114,000 jobs created to 89,000 – the lowest payrolls reading since December 2020. The latest data also showed that there were 1.3 million fewer native-born American workers in the workforce in August than there were a year ago, while foreign-born workers gained more than 1.2 million jobs in that timeframe.

HARRIS SAYS HER ECONOMIC PLAN WILL ‘PAY FOR ITSELF’

Health care was tied for the fourth most important issue among voters polled in the Fox News poll conducted Aug. 9-12, with 7% of respondents saying it was the top issue for them – tied with election integrity and trailing the economy (38%), immigration and abortion (14% each).

Harris has proposed expanding the health insurance premium subsidies under the Affordable Care Act that are due to expire at the end of next year. She has also said that her administration would accelerate Medicare prescription drug negotiations and work with states to cancel medical debt for millions of Americans.

Trump has said that Republicans will look to promote price transparency in health care as well as promote choice and competition to restrain cost growth. He has also called for expanding access to new, more affordable health care and prescription drugs.

US NATIONAL DEBT TO SURGE TO RECORD LEVELS WITHOUT REFORM, RAISING PROSPECT OF DEBT CRISIS

The federal government is projected to run a $1.9 trillion budget deficit in the current fiscal year and with spending on pace to accelerate in the years ahead as more baby boomers begin receiving Social Security and Medicare benefits.

The cost of servicing the national debt, which passed $35 trillion for the first time earlier this year, has risen due to elevated interest rates. In the first seven months of fiscal year 2024, spending on interest reached $514 billion – an amount more than what the federal government spends on defense ($498 billion) or Medicare ($465 billion) to that point.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The debt held by the public, a metric favored by economists that excludes debt held by the government itself, is projected to reach 99% of U.S. gross domestic product this year – which means the debt will equal the size of the economy. That is projected to rise above the 1946 record of 106% in 2027 and eventually rise to 166% of GDP in 2054, according to the nonpartisan Congressional Budget Office.