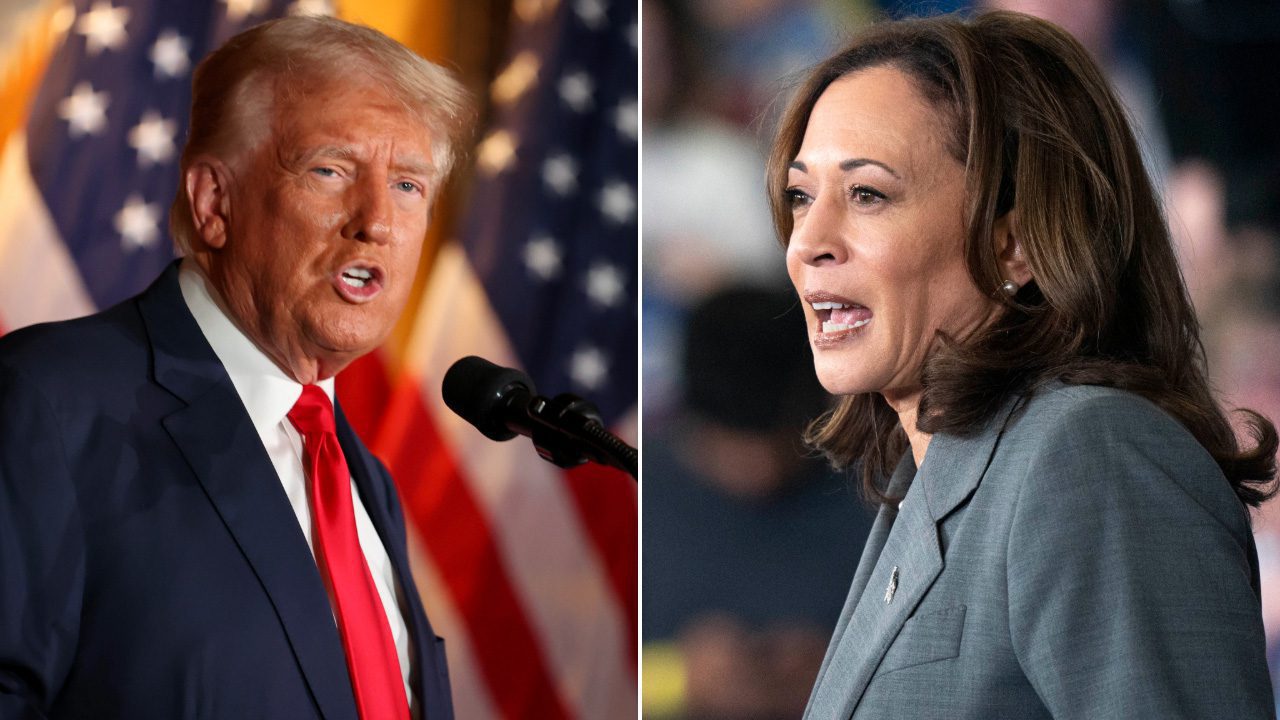

Former President Trump and Vice President Harris have been highlighting new tax policy provisions in their economic platforms in advance of their presidential debate on Tuesday night.

Harris and Trump are expected to argue their positions at Philadelphia’s National Constitution Center in a debate hosted by ABC News at 9 p.m. Eastern on Tuesday in what will be their first and potentially only meeting after President Biden withdrew from the race. The debate will be simulcast on Fox News and FOX Business Network.

The debate comes after both the Democrat and Republican presidential nominees outlined new elements of their tax plans in the last week.

Harris, whose campaign added a policy section to her website for the first time over the weekend seven weeks after Biden endorsed her as his successor, included provisions she says will make “our tax system fairer” and encourage investment that “leads to broad-based economic growth and creates jobs, which makes our economy stronger.”

WHERE DO TRUMP AND HARRIS STAND ON THE CHILD TAX CREDIT?

Among the policies listed on Harris’ website include quadrupling the tax on stock buybacks, imposing a 25% “minimum” tax on wealthy households and increasing taxes on capital gains and dividends for households making more than $1 million from 20% to 28%.

The nonpartisan Committee for a Responsible Federal Budget (CRFB) found that over the fiscal 2026-2035 period, the 25% minimum tax on realized and unrealized income for high-wealth households would raise tax revenue by $500 billion, while quadrupling the stock buyback tax would raise $150 billion. The higher tax rates on capital gains and dividends would raise $100 billion in additional revenue.

In a speech at the Economic Club of New York on Thursday, Trump said he would cut the corporate tax rate from 21% to 15% “solely for companies that make their product in America,” which he said would “further support the revival of American manufacturing.” He added that companies that “outsource, offshore or replace American workers” wouldn’t be eligible for the lower tax rate.

Though it’s unclear how that tax policy would be implemented, a CRFB analysis found that if Trump’s policy was structured similar to a past domestic production activity deduction to make eligible corporations’ effective tax rates 15%, it would lower federal tax revenues by about $200 billion from fiscal 2026 through 2035.

CHAMBER OF COMMERCE RELEASES TAX POLICY PRIORITIES AHEAD OF ELECTION

By comparison, lowering the corporate tax rate to 15% for all businesses would lower tax revenue by $460 billion per a dynamic analysis by the Tax Foundation, to $673 billion, according to the Tax Foundation’s static analysis. The Penn Wharton Budget Model estimates that tax revenue would be $595 billion lower over a decade under the policy.

Harris has proposed raising the corporate tax rate to 28% from the current 21%, after she had previously supported a 35% corporate tax rate during her short-lived presidential campaign in the 2020 cycle. The Harris campaign has described this as a “fiscally responsible way to put money back in the pockets of working people and ensure billionaires and big corporations pay their fair share.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The CRFB’s analysis found that increasing the corporate tax rate to 28% would raise tax revenue by $1 trillion from fiscal 2026 to fiscal 2035. The Tax Foundation’s analysis also projected that it would raise taxes by $1 trillion, while the Penn Wharton Budget Model estimated it would raise $1.2 trillion in revenue in that period.

Fox News’ Brooke Singman contributed to this report.