The Fed’s 50-basis point gift to Kamala. That’s the subject of the riff. 48 days before the election and it looks like Fed Chair Jay Powell just gave Kamala Harris a 50-basis point gift by slashing their target rate by half of 1%. This may well put the central bank smack in the middle of presidential politics – something they pledged not to do.

Now, in light of a modest decline in commodity prices and longer term interest rates, along with a softening in the labor market, a 25-basis point cut would seem to be justified in economic terms, with no political overtones, but a 50 bps super-cut sounds a lot like the ultra-liberal Democratic senators Elizabeth Warren, Sheldon Whitehouse, and John Hickenlooper, who were jawboning the Fed to lower interest rates by 75 basis points.

Not to mention, with 48 days until the election, there is no reason the Fed couldn’t have waited for their next meeting – in 49 days – and announced the rate cut the day after the election. Holding it off for 49 days would’ve had no economic impact, but it would’ve completely taken politics out of this whole story.

In truth, the overall economy is growing above the Fed’s 2% growth target. But while year-to-year inflation has softened to 2.5%, it remains above the Fed’s 2% inflation target. The problem has always been more of an affordability crisis, where consumer prices throughout the Biden-Harris term have increased faster than wages. The cost-of-living index is up about 20%, weekly wages are only up about 16% – so typical working families have lost about 4% in declining real wages.

During the Trump years, real wages rose by over 9%. Contrast that with the 4% drop during the Biden-Harris years. In dollar terms, real wages rose roughly $6,000 for a typical family during the Trump years, nearly 5 times the roughly $1,300 rise under Biden-Harris. Many prices for groceries, gasoline, electricity, home prices, insurance rates and autos have all increased by significantly more than 20%.

That was the Fed’s doing several years ago when they started monetizing all the Biden-Harris federal spending excesses. The Central Bank has continued to pump inflation until late 2022, when their argument that price hikes were temporary, or ‘transitory,’ proved to be foolhardy and dead wrong.

The affordability crisis has always been the Achilles heel of discredited “Bidenomics,” or whatever Kamala-nomics may be and, by the way, that includes high borrowing costs for home mortgages, car loans and especially credit cards. These are reasons why Kamala Harris is unable to answer the simple question, “Are you better off now than you were four years ago?”

She couldn’t answer during the debate, or her only one-on-one interview with a local Philadelphia TV station, or in her recent appearance before the National Association of Black Journalists. Now, perhaps the Fed has information that the entire economy is about to collapse – and that’s why they’re lunging for a 50-basis point super-cut, but that scenario seems unlikely.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

More to the point is that while Biden-Harris government spending continues to roar, the Fed is risking higher future inflation by pushing more money into the economy. Or, even worse, if Kamala were elected president with her roughly $5 trillion in across-the-board tax hikes that would suppress economic growth, and the Fed would continue a super-cycle of monetary easing, you’d have the classic super-inflation definition of “too much money chasing too few goods.”

Seems to me, Mr. Trump has a better idea – cutting taxes, deregulating, spending restraint, and “drill baby drill” lower oil prices, along with a stable dollar. That would promote rapid growth, without inflation, and end the Biden-Harris affordability crisis. That’s the riff.

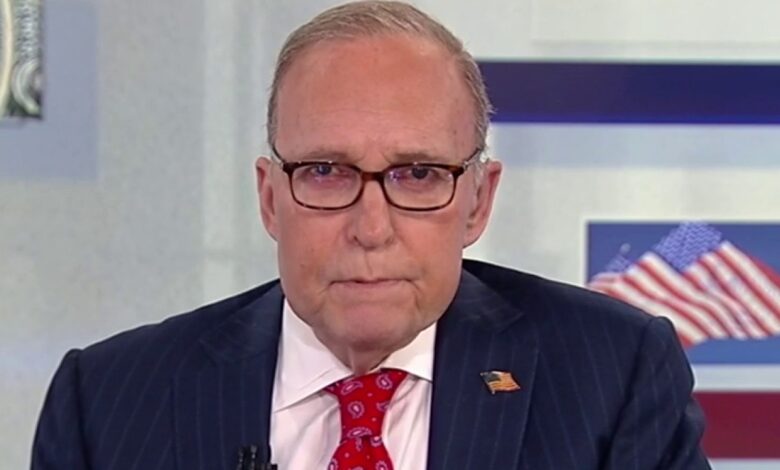

This article is adapted from Larry Kudlow’s opening commentary on the Sept. 18, 2024, edition of “Kudlow.”